There are many credit cards that may seem like they’re no longer available, but they’re still out there. Here’s a list of the best credit cards you can no longer get.

The guaranteed approval credit cards with $1,000 limits for bad credit are a type of credit card that can help people who have had a hard time getting approved in the past.

You Can’t Get the Best Credit Cards Anymore

on October 4, 2021 by Gary Leff

Points to Consider Guy writes an article on the five cards they miss the most that have been withdrawn. I believe the cards that will be missed the most are those that are missing. Here’s what they’ve got to say about it:

- Citi Prestige is no longer accessible to new cardholders, but it was a must-have four years ago. It used to include access to the Admirals Club, a very flexible fourth night free on hotel stays, and enhanced 1.6 cent redemption value spending points on American Airlines tickets. Those advantages are no longer available. In its more recent form as an excellent card for travel and dining expenditure, it’s difficult to classify it as the most-missed.

- Because it was a Platinum with no annual charge the first year, Ameriprise Amex Platinum was chosen. This isn’t even the finest Platinum Amex that’s no longer available, in my opinion (Mercedes-Benz).

- In the years since it vanished, Barclay Arrival Plus, a 2.1 percent rebate card when spending points for travel, has undoubtedly been surpassed.

- For many years, Starwood Amex was the go-to card for unbonused spending since you could earn 1.25 miles per dollar on your preferred airline before Chase Ultimate Rewards or Citi ThankYou Rewards, and it was also good for hotel stays. The Starwood Amex (albeit the personal Marriott Amex has decreased earn-value for expenditure) isn’t what I’m missing here; it’s Starwood itself.

- With online retail spending, Citi AT&T Access More offers 3 points each dollar.

Okay, they are OK as far as they go, but I don’t miss Arrival Plus or Citi Prestige when you can apply for a new one.

What are the cards that had enormous value but are no longer accessible, or that had a significant part in the evolution of where we are now?

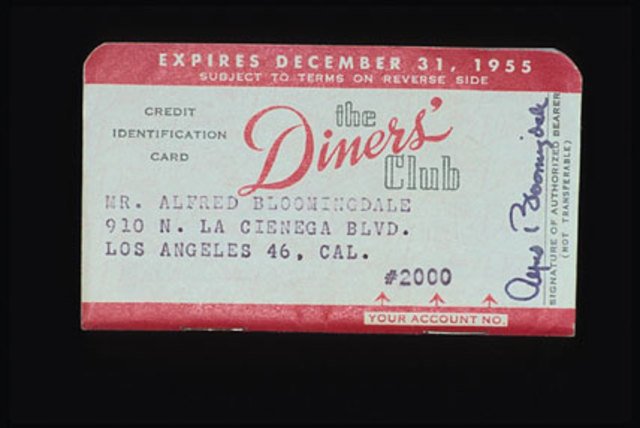

I’m not sure how you can provide this list without including Diners Club. Except for a short time in autumn 2014, it hasn’t been accessible to new cardmembers in the United States in years. Before it started processing charges on the Mastercard network, Diners Club was

- You have 60 days to pay. You didn’t have to be concerned about how quickly your company reimbursed business expenditures since you had two billing periods.

- Savings scheme for restaurants. Even when it was simply iDine Prime, participating restaurants received 20% cash back. It seemed strange to remove the restaurant savings program from the Diners Club card.

- Collision coverage for a rented vehicle. Chase provided the bonus on the Sapphire and United cards long before Chase did.

- Mileage transfer incentives, such as a 100 percent bonus on transfers to British Airways when British Airways Executive Club was a fantastic program, were offered.

You had to look around for a petrol station that accepted Diners Club. Acceptance was the card’s only restriction, but that’s also why it had to be so valuable to persuade cardholders to keep it in their wallet and put out the effort needed to use it (even if it was simply asking, “Do you accept Diners Club?”).

Furthermore, being the first credit card, it is historically significant.

I’d also include the Citi Driver’s Edge Card, which offered 6 points per dollar spent on petrol and groceries, matched by the number of miles driven. At petrol stations and grocery shops, you could earn 12 points for every dollar spent, which you could then redeem for 3 cents each.

- Domestic business class airfare was 3 cents per point (90,000 points purchased a $2700 ticket).

- You may cancel and keep a credit if the booking contained a non-refundable portion.

- Delta was particularly good at this since the initial ticket had to be issued in the name of the original passenger, but future tickets issued from that credit may be for other passengers.

Of course, back in the day, Citi’s Thank You program enabled you to buy flights with no price limits provided you followed the rules, and some people used their points to book $9000 non-refundable coach seats to Asia.

If we restrict ourselves to more recent goods, the Continental Presidential Plus Mastercard’s elite-earning potential was incredible — you could spend for status and even transfer status miles to other passengers. On the old Citi Forward Card, the 5x earning categories were fantastic. What about the Club Carlson Visa’s free second night on award stays?

What are the cards – and card perks – that you miss the most now that they are no longer available?

More From the Wing’s Perspective

The discover it credit card is a great credit card for those who want to travel. It has no annual fee and zero liability on fraudulent charges.

Related Tags

- guaranteed credit card approval no deposit

- first time credit card no credit history

- best credit cards 2021

- best cash back credit cards

- best credit cards to build credit