New York was a big win for President Trump and an even bigger win for the American people, but now that his time in office is winding down how should he go about leaving his legacy? One possible way would be to tackle other issues like immigration by using foreign policy as leverage.

The “American Airlines Strategy Analysis” is a blog post that discusses how American Airlines sees its new strategy going forward.

What American’s New York Strategy Will Look Like in the Future

on November 14, 2021 by Gary Leff

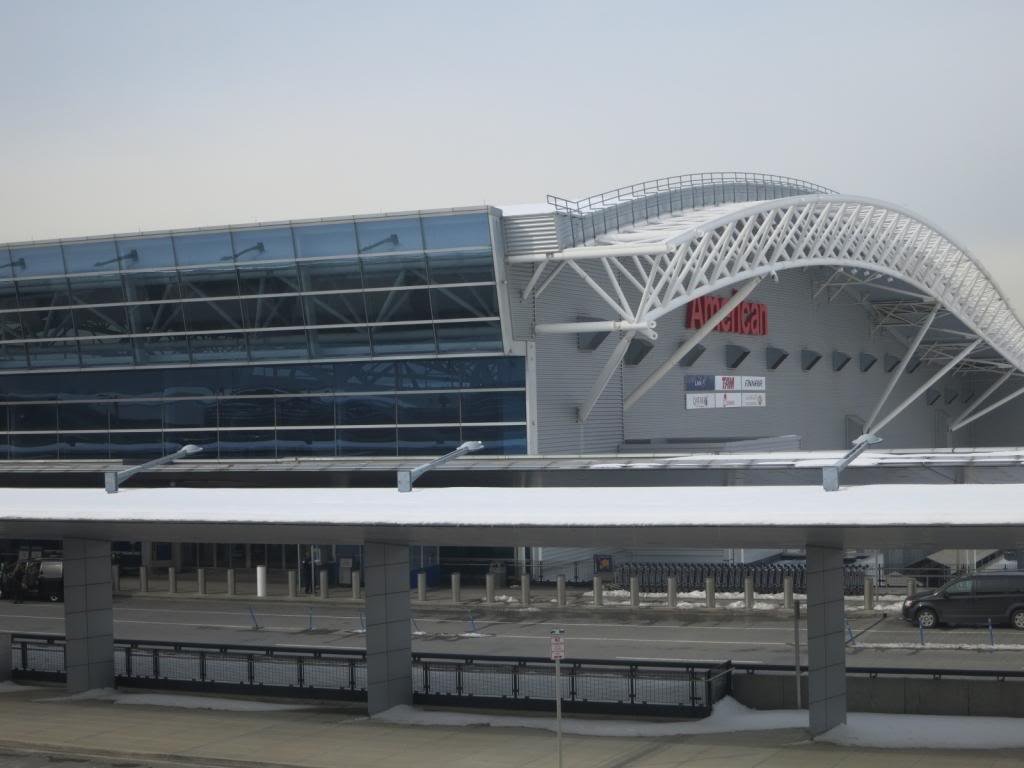

American Airlines Chief Revenue Officer Vasu Raja spoke at an employee Town Hall meeting on Tuesday, November 12 at LaGuardia airport on how the airline plans to approach the New York market in the future. Here are his eight insights on how things are changing for Americans in New York.

- To Raja, the network is the product, and integrating American’s and JetBlue’s networks offers them an edge.

The first and most important thing is that we must provide them with a fantastic product – a fantastic network – and as you can see from the timetable, we can now provide our clients with the finest. In New York, we’ll be approximately 100 exits ahead of our competition in January, and in Boston, we’ll be about 100 departures ahead.

…Instead of having a situation where our rivals virtually always provided more frequencies than AA, we will now be able to go to our consumers and claim that we have a better scheduling pattern than our competitors in something like 25 or 35 cities.

- Codesharing. This is how the two airlines market their flights to each other.

In the first quarter of this year, JetBlue will codeshare on 92 percent to 94 percent of American Airlines’ flight schedule.

- Working with JetBlue to place the appropriate aircraft on the appropriate route at the appropriate time. Given aircraft availability and capacity, they may substitute one airline for another on a route.

We are able to move AA and JetBlue out of markets in the same manner we move a 737 and a 319 in and out of markets as part of our cooperation with AA and JetBlue. And there will be a lot more of it in the future. So you’ll see that there isn’t an AA in Boston – LaGuardia on the January itinerary. That doesn’t rule out the possibility of flying Boston – LaGuardia again. We’re planning to operate practically the whole LaGuardia schedule as hourly patterns and move our metal in and out when JetBlue moves out of the Marine Air Terminal and co-locates with us here.

- However, the products will continue to be unique. Customers like free WiFi, which JetBlue delivers along with more legroom than American Airlines. Despite the fact that American was ready to match Delta with a free wifi announcement, expect American to start selling internet as part of a fare package rather than as an add-on.

We have corporate clients that want to fly us and value us because of our flight schedule, right? That’s a large part of the reason behind Main Cabin Select. We can fly you to Dallas, Charlotte, or anywhere you choose ten times a day. But they want a refundable ticket, and they want to know that when they arrive at the airport, they can choose any seat and have access to the club. And that’s exactly what we want to do.

We want to enhance that product in the future so that when you purchase it, you also receive free internet on the aircraft. [He shifts his focus to JetBlue’s operational integration, “ensuring that the bus between T5 and T8 at Kennedy functions well.”]

- American’s overseas routes will be filled by JetBlue’s loyal New York customers.

There are a number of things they do that are fantastic. When 6% of JFK-Tel Aviv passengers use JetBlue.com, it’s apparent that there’s a customer base that values the website that serves them, and we don’t want it to alter… We’re beginning to think about things like, if we’re going to be a serious contender in New York, we may not have enough premium seats on a widebody in the future.

…[O] One of the things that struck us the most once JetBlue began coding our flights was that suddenly, 8 or 9 percent of the individuals on Tel Aviv’s flights were arriving through JetBlue.com. It’s odd because they were simply New Yorkers who would go to JetBlue.com and hadn’t flown with us before. JetBlue.com was bringing in real New Yorkers who might otherwise have traveled on American Airlines.

- Because JetBlue has more aircraft overnighting in New York and those departures tend to be in the morning, they are more likely to conduct Caribbean trips than American.

- New York isn’t merely a stopover on the route to Europe. When the United States decided to de-emphasize New York, they regarded Philadelphia as their key European gateway, making New York less important. They now realize, however, that they can do more long-haul business with New York travelers than they can with European ones. Both Delhi and Tel Aviv are up and running ahead of time.

Owing to the restricted number of flights American can fly out of New York due to slot restrictions, more widebody long haul routes are likely to replace narrowbody short haul international services.

We boarded the Delhi aircraft, and to be honest, we had no idea how things would turn out. We anticipated that selling out premium accommodations would take the greater part of the year. It took around three months. Indeed, getting a premium ticket on American Airlines’ JFK – Delhi route for the remainder of the year is quite difficult. The booking performance between JFK and Tel Aviv has been outstanding.

And what we’ve never been able to exactly look like at JFK is that we can push a lot of connection across Kennedy, not only when we’re a significant originating carrier for clients in New York. And it leads us to a variety of locations. JFK has always been viewed as as largely serving the transatlantic market. We have a number of wonderful methods to develop transatlantic connection between JFK and Philadelphia.

What our eyes are really beginning to open to in New York is Israel, India, and the South American planes, which perform really well there. As a result, most of the issue is the same as it is in many of our other hubs. It’s not a question of where there’s demand; it’s a question of where the greatest spot to put an aircraft to garner the most demand and provide the best value to consumers.

…Our inclination is that if we can fly a widebody there, we prefer to do so than flying a narrowbody to Montego Bay since they both take up the same slot.

- The JetBlue relationship encourages new members to join the AAdvantage frequent flyer program, which means there’s a possibility to sign them up for credit cards and earn a percentage of their spending that goes beyond airline tickets.

For years, I’ve argued that American was losing out on credit card signups because they didn’t have a presence in the New York or Bay Area markets, where a lot of money is spent. And it indicates they misunderstood the New York potential – they’d mostly ignored it since US Airways management took over (first seeing New York as a hub for passengers from other locations, then running a ’boutique’ airline that wasn’t relevant to most consumers the majority of the time). They now recognize the significance of AAdvantage in New York.

We weren’t enrolling folks in the loyalty program at the same pace as they were leaving it in New York and Boston.

We achieved a record for registration in our loyalty program, the AAdvantage program, this past summer. We had 25% more enrollments in the domestic system than we had in 2019. Our previous high was in 2019. However, four cities led the way in terms of growth: New York, Boston, Los Angeles, and Seattle, in that order. Our AAdvantage enrollments increased by 50 percent to 60 percent in New York and Boston, while the remainder of our system rose by 25 percent.

More From the Wing’s Perspective

Leave a Reply

The “american airlines strategic objectives 2021” is the strategy that American Airlines has for their future. The company hopes to grow its market share in the U.S., while also expanding internationally.

Related Tags

- american airlines business strategy

- american airlines competitive strategy

- american airlines long term strategy

- american airlines strategic goals

- american airlines differentiation strategy